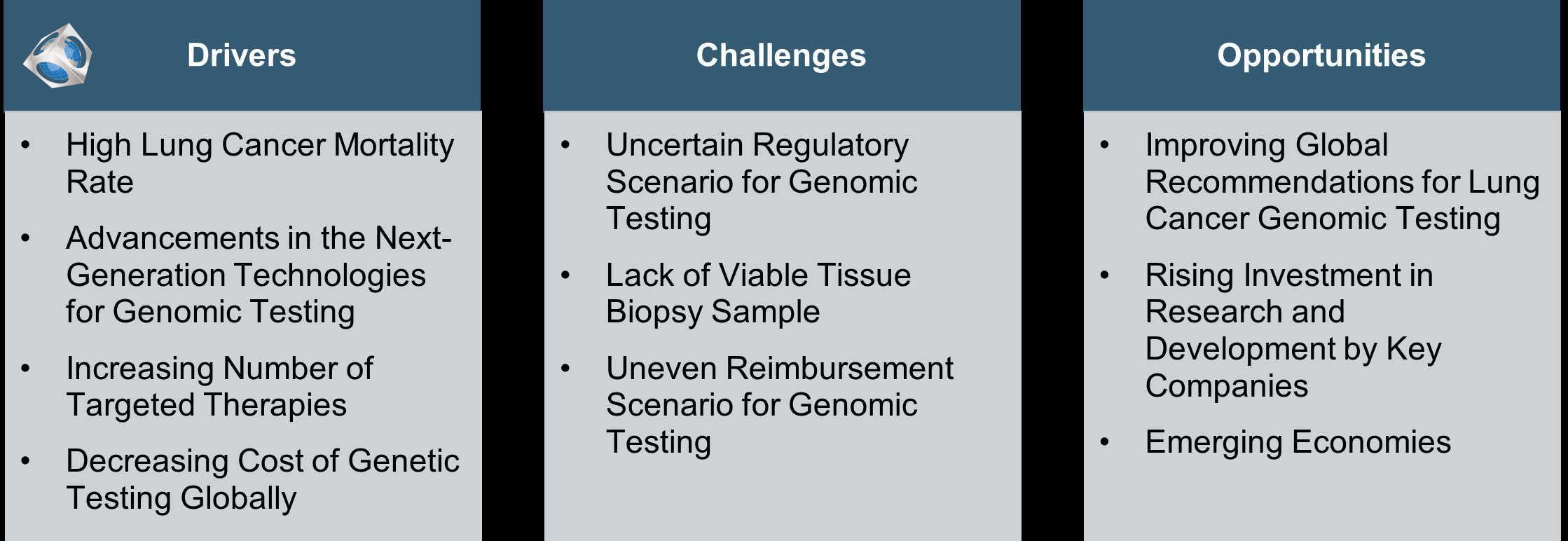

The global lung cancer genomic testing market has future potential. Various companies are increasing investments in research and development to facilitate the development of lung cancer genomic testing, which is expected to further increase the adoption of lung cancer genomic tests.

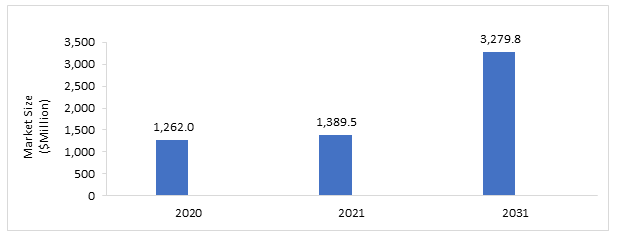

The lung cancer genomic testing medicine market was valued at $1,262.0 million in 2020 and is expected to reach $3,279.8 million by 2031, growing at a CAGR of 8.97% during the forecast period 2021-2031. The growth in the global lung cancer genomic testing market is expected to be driven by increasing awareness and adoption of the lung cancer genomic testing market, recent launches of novel lung cancer genomic testing, and the expanding research in the field of lung cancer with an emphasis on pharmacogenomics and development of companion diagnostics.

Impact of COVID-19

The global lung cancer genomic testing market is dominated by the utility in diagnostic laboratories, hospitals, and clinics. During the beginning of the COVID-19 pandemic, multiple countries witnessed a complete or a partial lockdown, and all elective surgeries and procedures were halted in the healthcare settings. Since the lung cancer genomic testing is categorized under the elective procedure, the impact of the COVID-19 pandemic on the lung cancer genomic testing was negative. BIS Research analysis has concluded that the market witnessed a drop of 3.24% in the annual growth rate of global lung cancer genomic testing market.

Market Segmentation

Segmentation 1: by Product Type

o Products

o Services

The global lung cancer genomic testing market services segment is expected to be dominated. This is owing to the easy availability, accessibility, and adaptation of LDTs, due to lower cost when compared with the product's market consisting of IVD.

Segmentation 2: by Technology

o Polymerase Chain Reaction (PCR)

o Next-Generation Sequencing (NGS)

o Fluorescence In Situ Hybridization

o Others

The global lung cancer genomic testing market by polymerase chain reaction (PCR) is expected to be dominated. This is owing to the overall cost efficiency and high sensitivity of the PCR-based genomic test for the detection of disease-causing mutations in lung cancer.

Segmentation 3: by Sample Type

o Tissue Biopsy

o Liquid Biopsy

The global lung cancer genomic testing market by tissue biopsy sample type is expected to be dominated. This is owing to the standard healthcare practice of extracting a lung tissue biopsy for lung cancer diagnosis, which is further utilized for lung cancer genomic testing.

Segmentation 4: by Panel Type

o Multi-Gene Panel

o Single-Gene Panel

The global lung cancer genomic testing market by multi-gene panel type is expected to be dominated. This is owing to the standard healthcare practice and familiarity of healthcare professionals with the extraction of lung tissue biopsy for lung cancer diagnosis, which is further utilized for lung cancer genomic testing.

Segmentation 5: by End User

o Research Organization

o Hospitals/Clinics

o Diagnostic Laboratories

o Other End Users

The global lung cancer genomic testing market by research organization end user is expected to be dominated. This is owing to a large number of clinical research and academic organizations where lung cancer genomic testing is utilized for drug development, development of companion diagnostics, and enrolment of patients in clinical trials.

Segmentation 6: by Region

o North America - U.S. and Canada

o Latin America - Brazil, Mexico, and Rest-of-Latin America

o Europe - U.K., Germany, Italy, Spain, France, and Rest-of-Europe

o Asia-Pacific - Japan, China, South Korea, Singapore, Australia, India, and Rest-of-Asia-Pacific

o Rest-of-the-World

The global lung cancer genomic testing market is expected to be dominated by North America, generating the highest revenue of $713.5 million. This is owing to the presence of a large number of research organizations and products and services companies in the U.S.

Global Lung Cancer Genomic Testing Market, Market Dynamics

Recent Developments in Global Lung Cancer Genomic Testing Market

• In December 2021, FDA approved Thermo Fisher Scientific’s NGS-based companion diagnostic for EGFR Exon20 insertion mutant non-small cell lung cancer tumor tissue Oncomine Dx Target Test, now approved for 12 NSCLC targeted therapies globally.

• In September 2021, FDA approved Thermo Fisher Scientific’s tissue-based NGS companion diagnostic for Takeda's targeted therapy for NSCLC patients with EGFR Exon20 insertion mutations- Oncomine Dx Target Test now approved as CDx for five targeted NSCLC therapies in the U.S.

• In September 2020, Laboratory Corporation of America Holdings entered into a commercial partnership with Resolution Bioscience; the company rolled out Resolution ctDx lung liquid biopsy test.

• In May 2021, Qiagen launched the first FDA-approved tissue companion diagnostic to identify the KRAS G12C mutation in NSCLC tumors and expanded precision medicine options in lung cancer.

• In January 2020, Qiagen built a global collaboration with Amgen for companion diagnostic development in non-small cell lung cancer.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, key developments, and market penetration.

Some of the prominent names established in this market are:

• QIAGEN N.V.

• Agilent Technologies, Inc.

• Thermo Fisher Scientific, Inc.

• Quest Diagnostics Incorporated

• Laboratory Corporation of America Holdings

• CENTOGENE N.V.

• BGI

• CeGaT GmbH

• Illumina, Inc.

• F. Hoffmann-La Roche Ltd.

• Abbott Laboratories

• CD Genomics

• NeoGenomics Laboratories

• Admera Health

• OncoDNA

• OPKO Health, Inc.

• Invitae Corporation

• Veracyte, Inc.

Companies that are not a part of the above-mentioned pool have been well represented across different sections of the report (wherever applicable).

Request Sample - https://bisresearch.com/requestsample?id=1301type=download

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of products, i.e., products (in-vitro diagnostic test) and services (laboratory developed tests) with respect to lung cancer genomic testing. Additionally, the study provides the reader a detailed understanding of the segmentation of the product and market analysis by technology, sample type, panel type, and understand the growth potential of the market by utilization based on the different end users.

Growth/Marketing Strategy: The global lung cancer genomic testing market has seen major development by key players operating in the market, such as product launches, synergistic activities, mergers and acquisitions, business expansion, partnership, collaboration, joint venture, and funding. The favored strategy for the companies has been synergistic activities and mergers and acquisitions, strengthening the product portfolio and their position in the lung cancer genomic testing market. For instance, in February 2022, Foundation Medicine Inc. announced its collaboration with Eli Lilly and Company to develop FoundationOne CDx and FoundationOne Liquid CDx as companion diagnostics for RETEVMO, which was FDA approved in May for non-small cell lung cancer patients.

Competitive Strategy: Key players in the global lung cancer genomic testing market analyzed and profiled in the study involve the product manufacturer and test service providers. Moreover, a detailed competitive benchmarking of the players operating in the global lung cancer genomic testing market has been done to help the readers understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

BIS Related Reports

Global Companion Diagnostics Market

U.S. Solid Tumor Testing Market - Analysis and Forecast, 2019-2030