The growing interest of the pharmaceutical industry in the therapeutic potential for treating axial spondyloarthritis has been a catalyst for the progress in the global axial spondyloarthritis market.The companies operating in the global axial spondyloarthritis market are now focusing more on biologics and personalized therapy to enhance therapeutics and improve patient outcomes. Increasing investments in the research and development of drug manufacturing is one of the major opportunities in the global axial spondyloarthritis market.

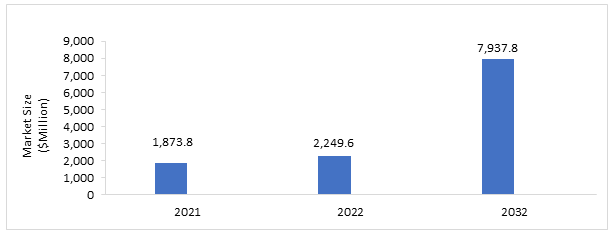

The global axial spondyloarthritis market was estimated to be at $1,873.8 million in 2021, which is expected to grow with a CAGR of 13.44% and reach $7,937.8 million by 2032. The growth in the global axial spondyloarthritis market is expected to be driven by the introduction of novel products, the increasing awareness about the disease, and the rising research and development investments, among others.

Impact

With an increased worldwide focus on treating axial spondyloarthritis, the major market players are developing novel therapeutics, such as anti-janus kinase therapy, anti-interleukin therapy, and anti-tumor necrosis factor therapy, which is significantly impacting the growth of axial spondyloarthritis market. Due to the introduction of tumor necrosis factor inhibitors and interleukin 17 inhibitors, a new era of drug therapy was initiated for previously largely incurable diseases. For instance, the U.S. Food and Drug Administration approved three novel products, i.e., Xeljanz, Taltz, and Cosentyx, in 2020 and 2021 to treat patients with axial spondyloarthritis.

Drug development is more prominent in countries such as the U.S., Germany, and the U.K. Moreover, the presence of major market players such as UCB S.A., Johnson Johnson Services, Inc., Merck Co., Inc., Pfizer, Inc., Eli Lilly and Company, and Novartis International AG in seven major countries, including the U.S., EU4 (Germany, France, Spain, Italy) and U.K., and Japan have a positive impact on the market growth.

Market Segmentation

Segmentation 1: by Commercialized Therapies

• Anti-Tumor Necrosis Factor (TNF) Therapy

• Anti-Interleukin (IL) Therapy

• Anti-Janus Kinase (JAK) Therapy

In 2021, the global axial spondyloarthritis market in the commercialized therapies segment was dominated by the anti-tumor necrosis factor therapy segment. Years of successive and significant innovations in anti-tumor necrosis factor therapies have demonstrated tremendous potential in treating distinct indications of axial spondyloarthritis.

Segmentation 2: by Potential Pipeline Products

• Anti-Janus Kinase (JAK) Therapy

• Anti-Interleukin (IL)-17 Therapy

• Other Therapy

In 2032, the global axial spondyloarthritis market is estimated to be dominated by the anti-interleukin 17 therapy and is expected to hold a 39.49% share of total potential pipeline products. Other therapy includes anti-Granulocyte/macrophage colony stimulating factor (GM-CSF) therapy and anti-phosphodiesterase 4 (PDE4) therapy.

Segmentation 3: by Indication

• Ankylosing Spondylitis

• Non-Radiographic Axial Spondyloarthritis

The ankylosing spondyloarthritis segment dominated the global axial spondyloarthritis market in 2021 due to a greater number of product approvals in seven major countries compared to non-radiographic axial spondyloarthritis.

Segmentation 4: by Country

• U.S.

• Germany

• France

• U.K.

• Italy

• Spain

• Japan

The U.S. axial spondyloarthritis market was valued at $1,231.2 million in 2021 and is the leading market contributor. The growth can be attributed to the increased research and development activities in the country.

With an increased worldwide focus on treating axial spondyloarthritis, the major market players are developing novel therapeutics, such as anti-janus kinase therapy, anti-interleukin therapy, and anti-tumor necrosis factor therapy, which is significantly impacting the growth of axial spondyloarthritis market. Due to the introduction of tumor necrosis factor inhibitors and interleukin 17 inhibitors, a new era of drug therapy was initiated for previously largely incurable diseases. For instance, the U.S. Food and Drug Administration approved three novel products, i.e., Xeljanz, Taltz, and Cosentyx, in 2020 and 2021 to treat patients with axial spondyloarthritis.

Impact of COVID-19

The COVID-19 pandemic has exerted tremendous strain on the research and clinical development of axial spondyloarthritis emerging therapies. Companies operating in axial spondyloarthritis have changed their focus on the research and development of drugs used for COVID-19 treatment to help governments and communities establish a new normal across the globe. This has resulted in the delayed launch of emerging therapies due to a shift in priorities regarding the COVID-19 pandemic.

However, with the ease of restrictions after the second quarter of 2020 coupled with the commencement of transportation activities, the market for axial spondyloarthritis has gained significant momentum and is anticipated to grow during the forecast period 2022-2032.

Recent Developments in the Global Axial Spondyloarthritis Market

• In December 2020, AbbVie's Upadacitinib (RINVOQ) met primary as well as secondary endpoints in the Phase III study for non-radiographic axial spondyloarthritis.

• In August 2020, AbbVie, Inc. submitted an application to the U.S. Food and Drug Administration (FDA) to seek approval for RINVOQ (Upadacitinib) to treat adult patients with active ankylosing spondylitis.

• In March 2020, Novartis International AG received a positive CHMP opinion which recommended a positive opinion for Cosentyx for the treatment of active non-radiographic axial spondyloarthritis (nr-axSpA).

• In June 20219, Kyowa Hakko Kirin Co., Ltd. stated a positive result of a 16-week efficacy and safety analysis of the Phase 3 study of Brodalumab in patients with ankylosing spondylitis and non-radiographic axial spondyloarthritis.

Demand – Drivers and Limitations

Following are the demand drivers for the global axial spondyloarthritis market:

• The Introduction of Novel Products

• Increasing Awareness About the Disease

• Rising Research and Development Investments

The market is expected to face some limitations too due to the following challenges:

• High Treatment Cost Impacting the Adoption Rate

• Increased Delay in Diagnosis

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Total Number of Companies Profiled: 12

Public companies include AbbVie Inc., Amgen Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Johnson Johnson Services, Inc., Kyowa Kirin Co., Ltd., Merck Co., Inc., Novartis International AG, Pfizer Inc., Takeda Pharmaceutical Company Limited, and UCB S.A. The private company profiled is FunPep Co., Ltd.

Request Sample Report - https://bisresearch.com/requestsample?id=1299type=download

Key Questions Answered in the Report

- What are the major market drivers, challenges, and opportunities in the global axial spondyloarthritis market?

- What are the underlying structures resulting in the emerging trends within the global axial spondyloarthritis market?

- How has the COVID-19 pandemic impacted the global axial spondyloarthritis ecosystem?

- What are the key development strategies that are being implemented by the major players to sustain themselves in the competitive market?

- What is the pricing and reimbursement scenario in the field of axial spondyloarthritis?

- What are the potential emerging therapies present in the pipeline for axial spondyloarthritis?

- What are the key regulatory implications in major geographies pertaining to axial spondyloarthritis?

- What are the potential entry barriers which are expected to be faced by the companies willing to enter a particular country?

- How is each segment of the market expected to grow during the forecast period 2022-2032, and what is the anticipated revenue to be generated by each of the segments?

- Following are the segments:

- Commercialized Therapies

- Potential Pipeline Drugs

- Indication (ankylosing spondylitis and non-radiographic axial spondyloarthritis)

- Countries (U.S., Germany, France, the U.K., Italy, Spain, and Japan)

- What are the growth opportunities for the companies in the country of their operation?

- Who are the leading players with significant offerings in the global axial spondyloarthritis market?

- Which companies are anticipated to be highly disruptive in the future, and why?

BIS Related Studies